What documents are required for the import of electronic components?

Electronic component import certificates refer to a series of certification documents that need to be processed in accordance with national laws, regulations and relevant policy requirements when importing electronic components, including import licenses, automatic import licenses, 3C certifications, etc., to prove the authenticity of the goods. Legality, safety and compliance with quality standards.

Detailed introduction to the documents and procedures required for the import of electronic components

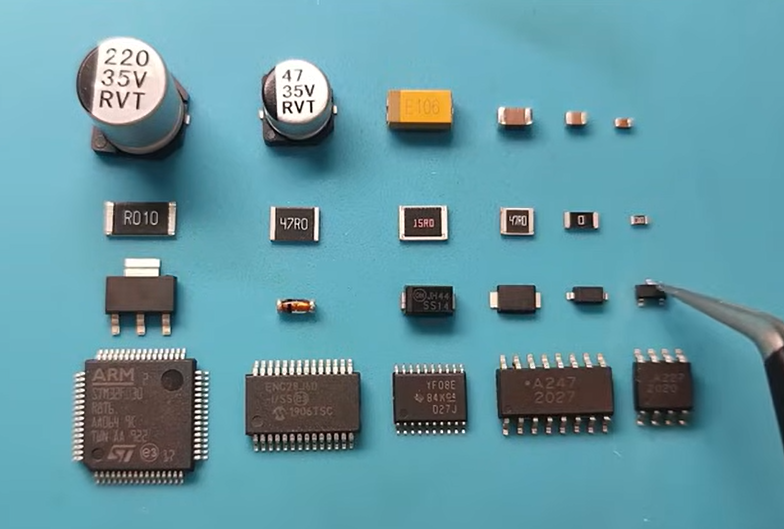

As the basic component of modern electronic equipment, the import business of electronic components occupies an important position in global trade. Due to the wide variety of electronic components, their high technical content, and the involvement of national security, environmental protection, quality and other factors, a series of documents and procedures are required when importing. The following will provide a detailed introduction to the documents and procedures required for the import of electronic components.

Documents required for import

Import license

According to relevant national laws and regulations, some electronic components are restricted import commodities and require advance application for an import license from relevant national departments. When applying for an import license, you need to provide the importer’s basic information, imported commodity list, technical specifications, usage description and other materials. Import operations can only be carried out after obtaining the import license.

Automatic import license

For some electronic components, such as sensitive products involving national security, environmental protection and other factors, you need to apply for an automatic import license.

The application process for an automatic import license is similar to that of an import license, but the approval process is more stringent. Import operations can only be carried out after obtaining an automatic import license.

3C certification

3C certification is the abbreviation of China Compulsory Product Certification. It is a compulsory product certification system implemented for some products involving personal safety, animal and plant life safety, environmental protection and national security. Some electronic components such as power adapters, switching power supplies, etc. require 3C certification. When applying for a 3C certification, you need to provide product technical specifications, test reports, manufacturer information and other materials. After obtaining the 3C certification, import and sales can be carried out.

Certificate of origin

Certificate of origin is an official document proving the origin of goods, usually issued by the government of the exporting country or relevant agencies. When importing electronic components, you need to provide a certificate of origin to prove the source of the goods and enjoy relevant tariff preferential treatment. The process for applying for a certificate of origin varies from country to country and region. Generally, you need to provide the exporter’s basic information, product list, production process and other materials.

Packing list, invoice and contract

Packing list, invoice and contract are the basic documents for imported electronic components. The packing list details the product name, specifications, quantity, weight and other information of each box of goods; the invoice lists the price, total amount and other information of the goods; the contract stipulates the rights and obligations of the buyer and seller. These documents are essential when going through import customs declaration procedures.

Import process of electronic components in China

Sign foreign trade contracts with foreign suppliers

Before importing electronic components, you first need to sign a foreign trade contract with a foreign supplier. The contract should clearly stipulate the product name, specifications, quantity, price, delivery period and other terms of the goods. At the same time, both parties should reach an agreement on payment methods, transportation methods, etc. Signing a foreign trade contract is the first step to import electronic components, and it is also an important measure to protect the rights and interests of both parties.

Apply for import license and automatic import license (if necessary)

According to relevant national laws and regulations, some electronic components require an import license or automatic import license. After signing a foreign trade contract, you should promptly apply for relevant certificates from the relevant national departments. After obtaining the certificate, subsequent operations can be carried out.

Apply for 3C certification (if necessary)

For some electronic component products involving personal safety, animal and plant life safety, environmental protection and national security, 3C certification is required. When applying for a 3C certification certificate, the application and testing should be carried out in accordance with relevant national standards and procedures. After obtaining the 3C certification, import and sales can be carried out.

Prepare documents such as packing list, invoice and contract

Before the goods are shipped, documents such as packing lists, invoices and contracts should be prepared. These documents should detail the product name, specifications, quantity, price and other information of the goods, and comply with international trade practices and relevant national regulations. Only after the documents are ready can subsequent operations be carried out.

Arrange transportation and insurance matters

According to the provisions of the foreign trade contract and the actual situation, select the appropriate transportation method and insurance company for cargo transportation and insurance. The mode of transportation can be sea transportation, air transportation or land transportation; insurance companies should choose insurance companies with good reputation and high quality services for insurance. Ensuring the safety and security of goods during transportation is one of the important aspects of importing electronic components.

Complete import declaration procedures

After the goods arrive at the destination port, they should be declared to the customs in time and go through the import declaration procedures. When going through customs declaration procedures, complete documentation should be provided and duties and other taxes should be paid in accordance with regulations. The goods can be released for pickup only after the customs has inspected and reviewed the goods. It should be noted that some electronic components may require statutory inspection or commodity inspection before being released for delivery. Therefore, you should understand the relevant regulations and requirements and make preparations in advance before going through customs declaration procedures.

Arrange domestic transportation and warehousing matters

After the goods are released for pickup, domestic transportation and warehousing matters should be arranged in a timely manner to transport the goods to the destination and properly kept to ensure the safety and integrity of the goods during transportation and to facilitate subsequent sales and use.

When arranging domestic transportation and warehousing matters Factors such as the characteristics, quantity, and transportation distance of the goods should be taken into consideration and appropriate transportation methods and warehousing facilities should be selected to reduce costs and improve efficiency to ensure that the entire import process proceeds smoothly and achieves the desired results.

The above content introduces in detail the documents and overall procedures required for the import of electronic components. In actual operations, enterprises should fully understand the relevant policies and regulatory requirements and actively cooperate with government departments to ensure the smooth progress of the business and also strengthen their own awareness of compliance. and risk management capabilities to avoid losses and risks resulting from regulatory violations.