Panoramic map of China’s automotive chip industry in 2024: covering automotive chip manufacturing, vehicle system manufacturing, vehicle instrument manufacturing, and vehicle manufacturing, highlighting the core role of automotive chips in intelligent driving and assisted driving systems.

The core data source of this article: China’s automotive chip market size; China’s automotive chip regional competition pattern; China’s automotive chip market supply

Chip Industry Overview

Definition

Automotive chips refer to semiconductor products used in car body automotive electronic control devices and vehicle-mounted automotive electronic control devices.

From an application perspective, cars as small as the tire pressure monitoring system TMPS and cameras, as large as vehicle controllers and autonomous driving domain controllers are all inseparable from a variety of chips.

Industry chain analysis

In the automotive chip industry chain, the upstream generally refers to basic semiconductor materials (silicon wafers, photoresist, CMP polishing fluid, etc.), manufacturing equipment and wafer manufacturing processes (chip design, wafer foundry and packaging testing); the midstream generally refers to The automotive chip manufacturing process includes main control chips, memory chips, communication chips, power chips, etc.; the downstream includes automotive system manufacturing, automotive instrument manufacturing, and vehicle manufacturing.

In terms of manufacturers, the upstream includes semiconductor materials and equipment manufacturers, Foundry factories, packaging and testing factories, etc., such as Shin-Etsu, Shanghai Silicon Industry, Nanda Optoelectronics, AMAT, ASML, Northern Huachuang, TSMC, UMC, SMIC, ASE, Changchun Electronic Technology, Tongfu Microelectronics, etc.; midstream includes GPU, FPGA, ASIC, MCU, DSP and other chip design and manufacturing manufacturers, such as NVIDIA, AMD, Infineon, Renesas, NXP, Freescale, etc.; downstream It includes central control instruments, radar manufacturing, Internet of Vehicles systems, assisted driving, vehicle manufacturing and other manufacturers, such as Nippon Seiki, Bosch, Magna, Hongquan IoT, Zhongtian Anchi, Volkswagen, Toyota, Ford, General Motors, Tesla et al.

Industry development history

China’s automotive chip development is mainly divided into four stages: the first stage (before 1970), mainly based on traditional car audio speakers and ignition devices; the second stage (1970-1980), mainly based on power and braking systems Mainly, involving ABS, EPS, etc.; the third stage (1980-1990) mainly focuses on active safety products such as tire pressure monitoring, ESC, road monitoring; the fourth stage (2000-present) involves more and more drivers Assistance, smart cockpit, new energy and other systems.

Industry policy background

From 2017 to 2023, the national level has issued a series of guidance suggestions and supporting policies on the technical level and product quality of the automotive chip industry. At the same time, relevant key planning has been carried out for the standard system construction guidelines for the automotive chip industry. The specific content is summarized. as follows:

Industry development status

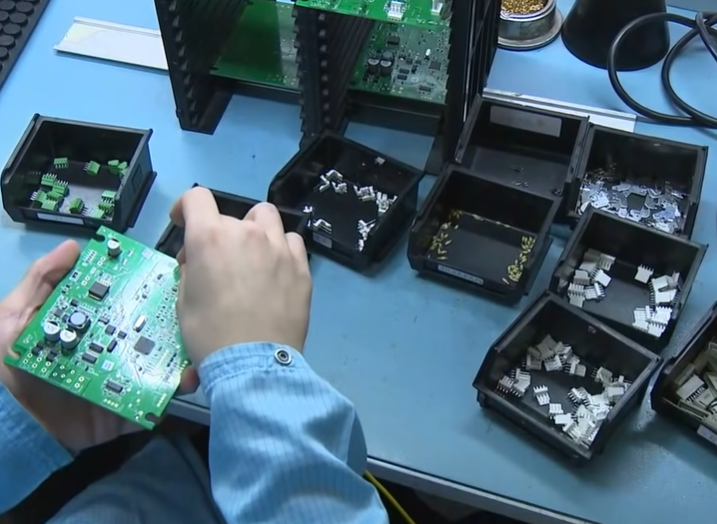

Market supply situation of China’s automotive chip industry

Representative manufacturers of automotive chips in China include Vail, Shengbang, GigaDevice, etc. Among them, Vail Co., Ltd. ranked first with 9.123 billion pieces, followed by Shengbang Co., Ltd. with a production of 4.965 billion pieces. Among them, the output of power chips and analog chips is relatively higher. As China’s automobiles rapidly develop toward electrification, intelligence, and connectivity, the demand for various types of automobile chips increases, and the output of automobile chip manufacturers will also increase accordingly.

Market demand status of China’s automotive chip industry

In 2022, Vail’s automotive chip sales ranked first with 9.697 billion units, followed by Shengbang with sales of 4.637 billion units. Among them, the sales of power chips and analog chips are relatively higher. As China’s automobiles rapidly develop toward electrification, intelligence, and connectivity, automobile manufacturers are increasing their technological research and development of various types of main control chips. Domestic automobile chip manufacturers will usher in good opportunities for development in the future.

China’s dependence on foreign automobile chips

At the China Electric Vehicles Forum of 100 People (2023) held in March 2023, the Institute of Market Economics of the Development Research Center of the State Council stated that my country’s external dependence on automotive chips is as high as 95%, the self-sufficiency rate of computing and control chips is less than 1%, and power and The self-sufficiency rate of memory chips is only 8%. To achieve domestic substitution in the field of automotive chips, it is necessary to strengthen the internal coordination and external circulation of the automobile and chip industries in the short term to create a good development environment and expectations for automobile manufacturing companies; in the long term, it is necessary to implement a support system for the development of the chip industry and promote the independence of the chip industry. Safe and controllable.

China’s automotive chip market size

From the perspective of my country’s automotive chip market, key system chips such as my country’s advanced sensors, in-vehicle networks, three electrical systems, chassis electronic controls, ADAS (Advanced Driving Assistance Systems), and autonomous driving are all monopolized by companies in developed countries, resulting in the chip cost of my country’s automobiles Fees have always been higher. According to data from the China Automotive Chip Industry Innovation Strategic Alliance, the cost of automotive chips in my country will be approximately US$534/car in 2021, and may reach US$600/car in 2022. Preliminary estimates indicate that my country’s automotive chip market may reach US$16.2 billion in 2022. Combining the current status of my country’s automotive chip industry and its development prospects, Qianzhan preliminarily estimates that the market size of China’s automotive chip industry may reach US$19.7 billion in 2023.

Industry competition landscape

- Regional competition: The automotive chip industry focuses on Guangdong

According to Qichamao query data, China’s registered automotive chip companies are currently mainly distributed in coastal provinces such as Guangdong and Jiangsu. Among them, Guangdong Province has the highest number of automotive chip industry companies, reaching 1,207, and Jiangsu Province ranks second in the number of automotive chip industry companies. For 572 households.

- Enterprise competition: International giants occupy the high-end market of the automotive chip industry

At present, domestic companies with the ability to produce automotive chip products mainly include Wingtech Technology, Beijing Ingenics, Vail Co., Ltd., BYD Semiconductor and other companies, focusing on the mid-to-low-end market. In the high-end automotive chip market, such as automotive main control chips, high-end sensors and other fields, it is mainly concentrated in foreign companies such as NXP, Infineon, and STMicroelectronics.

Industry development prospects and trend forecasts

China’s automotive chip technology innovation trends

The technological innovation of future automotive chips includes three dimensions: chip material innovation, chip design innovation and manufacturing process innovation. In terms of material innovation, SiC power devices have great development potential in the field of new energy vehicles and are mainly used in main drive inverters, on-board charging systems OBC, on-board power converters DC/DC and off-board charging piles. Although China’s SiC development started lagging behind, it has achieved significant results. In terms of design innovation, chip design takes performance and security as the core goals and driving forces. In the face of increasingly large and complex automotive data, it is urgent to improve chip computing performance. Many chip manufacturers improve the overall computing efficiency of the chip through multiple integrated high-frequency cores. High-frequency and high-performance chips have become the mainstream of design. In terms of process innovation, the scale of information data is increasing day by day. Intelligent upgrades place higher requirements on the computing performance of vehicle-mounted computing control chips. At the same time, car sales are rising day by day, the amount of cores used in bicycles is growing, and large-scale mass production is helping to reduce costs and increase costs. The demand for efficiency continues to increase, prompting chip manufacturers to continue to pursue lower processes to achieve performance improvement and cost reduction.

China’s automotive chip market is growing rapidly

At present, China has made breakthroughs in the semiconductor field. Although it is still in a weak position in automotive-grade semiconductors, it is gradually realizing import substitution in home appliances, industry and other fields. In the field of automotive-grade IGBT, BYD has made a breakthrough.

Some of Star Semiconductor’s products are used in the field of new energy vehicles. These are signs of China’s breakthrough in automotive-grade semiconductors. In addition, domestic listed companies acquire and integrate major global semiconductor companies through capital operations, such as Wingtech Technology’s acquisition of Nexperia Semiconductor and Vail’s acquisition of OmniVision Technology.

Through mergers and acquisitions and organic development, China’s automotive-grade semiconductors are expected to achieve major breakthroughs and achieve import substitution. Relevant automotive semiconductor companies are expected to benefit deeply from the opportunities brought by import substitution and automotive electric intelligence to significantly increase the value of bicycle semiconductors. According to Bloomberg, 19 of the world’s 20 fastest-growing chip industry companies in recent years are from mainland China.

China is the region with the fastest growth rate and the largest market demand in the global automotive chip industry. Based on the market growth rate of China’s automotive chips in recent years, Qianzhan preliminarily estimates that the compound growth rate of my country’s automotive chip scale may reach 22% in the future, and is expected to reach 22% by 2029. China’s automotive chip transaction size is expected to reach US$65 billion in 2018, with an average annual compound growth rate of 22%.

For more detailed research and analysis on this industry, please see the “China Automotive Chip Industry Market Forecast and Investment Strategic Planning Analysis Report” by the Qianzhan Industry Research Institute.

At the same time, Qianzhan Industry Research Institute also provides solutions such as industrial big data, industrial research reports, industrial planning, park planning, industrial investment promotion, industrial maps, smart investment promotion systems, industry status certification, IPO consulting/funding feasibility study, IPO working paper consultation, etc. .